- Is it about peering? And then: is traffic direction relevant at all?

- Is it about competition, or lack thereof? And then: does an ISP hold a monopoly on 'termination'?

- Is it about net neutrality? And then: is it about Netflix, which has a new deal with Level 3? And: is it about Comcast's NBC takeover?

- Who should pay: Netflix, Level 3, Comcast, or the consumer? And then: should anyone of these be paid twice?

- Is it all about opinions, or is there some way to look at it in an neutral and objective manner?

Tuesday, December 21, 2010

What if Netflix switched form pigeons to postage?

Sunday, October 31, 2010

Intel's hybrid STB customers racing for a pre-Holiday launch

Google TV is out on a Logitech box and a Sony TV and Blu-ray player. In an information alert, In-Stat's Gerry Kaufhold mentions video quality issues (frame rate, no support for WMV or DTS, limited storage) and content blocking (ABC, NBC, CBS, others).

Google TV is out on a Logitech box and a Sony TV and Blu-ray player. In an information alert, In-Stat's Gerry Kaufhold mentions video quality issues (frame rate, no support for WMV or DTS, limited storage) and content blocking (ABC, NBC, CBS, others).Content seems to be the least of their problems. The other issues are much deeper, could involve memory leaks, and are probably behind the ongoing delays that have plagued both Boxee (slated for November 10) and Yuixx (which is aiming for a pre-Holiday launch as well) - and most other Intel customers.

The race is still on, especially among the dozen (?) or so Intel customers, to get a hybrid STB out onto the market beyond a prototype or demonstration. And it's not just the software, it's DRM, content, distribution and a bunch of licenses (Dolby, DTS, etc.) as well that need to be taken care of.

Check out our coverage of OTT. Free commentaries (updated April 20, 2011):

Connected TV brings new competitor for operators: CE manufacturers (April 20, 2011)

Hollywood struggles with broadcast rights and the iPad (April 4, 2011)

Amazon takes Lovefilm out of DECE, launches own cloud service (March 29, 2011)

Entertain Sat: Deutsche Telekom and SES Astra's clever cooperation (March 1, 2011)

Broadcast TV resurgent, but OTT players add a little extra (February 25, 2011)

Vodafone Germany's hybrid STB offers little to distinguish it (February 17, 2011)

Ziggo feels the heat and looks to spark up connected TV (February 3, 2011)

Connected TV puts network operators to work (January 21, 2011)

Microsoft, Google, Nokia Siemens trail the Connected TV market at CES

French govt should ask why Sony hasn't contributed to the cost of the electricity network

Google TV frustrated by Hollywood

TiVo transforms iPad into 2nd screen with a remote control

Google TV takes on the couch potato

BBC can enforce Net Neutrality through sheer market power

Belgacom takes new steps in expanding IPTV services

Is KPN planning its own version of UPC's Horizon box?

Nimbuzz versus Skype, Google versus ABC

Network pressure from Netflix shows success of OTT video

YTL, Sezmi bring quad-play with OTT over Wimax in Malaysia

Cisco's umi and Logitech's Revue: two new connected devices

Google TV marks important step with content deals

Battle starts for OTT market

Apple's iTV heats up competition on OTT market

Your.TV: waiting for DRM, content and distribution deals

Intel looks to break open connected TV market

ltra-Violet: the virtual successor to Blu-ray

Google optimises YouTube for mobile and TV

Can Google, Apple and Philips beat UPC and Telstra?

Google, Sony and Intel enter the living room

Time's running out for operators that want to profit from OTT

Metrological develops strong position on OTT market

Google targets operator market again with TV plans

Qualcomm hints at multi-function media gateway

Convergence expands to the TV

Liberty Global hints at consolidation, OTT box

Who's going to bring OTT content to the TV?

Apple poses threat to cable sector

And a series of Research Briefs:

Defining Connected TV

Three reasons for operators to launch OTT services

Google TV: lots to offer

OTT: distribution as a scenario for operators

Connected TV allows operators to benefit from OTT content

And the Global Connected TV 2011 report:

Global Connected TV 2011

Google doc: still not doing evil

Sunday, October 10, 2010

HFC: lines are 97% fiber, but route km just 6%

- Computer (desktop, laptop)

- Connected TV, hybrid STB

- Blu-ray player

- Game console

- Smartphone, iPhone

- LiveView (Sony Ericsson's new 'data pager')

- E-reader, Kindle, Nook

- iPad, notebook, tablet, netbook, smartbook, speedbook, booklet, ....

- Femtocell

- umi (Cisco's video calling box)

Sunday, October 03, 2010

Monday, September 13, 2010

Google TV meets Google Fiber and YouTube Live

- 1 Gb/s. The 100 Mb/s bar is gradually being left behind (Docsis 3 doing 120, Comcast 105, Bell Aliant 170) and there are several 1 Gb/s services around now. Most recently, it was launched by EPB Fiber Optics of Chattanooga (Tennessee). It comes at 350 $/mo. Other 1 Gb/s service news relates to Costa Rica and Hong Kong.

- Open access. Wholesale-only business models are springing up rapidly. LightSquared (US) and CenterNet/Mobyland (Poland) are planning LTE networks, Allied Fiber is into fiber backhaul, the Australian NBN is making progress, so is the New Zealand UFB network, while eircom is planning trials and Covage is rolling out in France.

- YouTube Leanback is an optimised version for Google TV.

- YouTube.com/movies will offer movies.

- YouTube HD was launched some time ago.

Tuesday, August 31, 2010

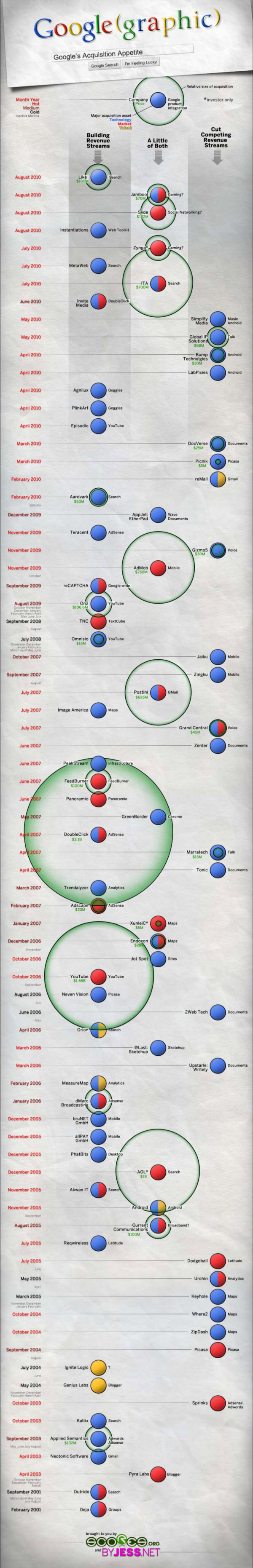

Google's Acquisitions

Thursday, August 26, 2010

TD-LTE: an introduction

Defining TD-LTE:

LTE (Long Term Evolution) is the fundamental and primary technology for the development of 4G technology, which is an evolution of 3G networks. TDD (Time Division Duplex) version of LTE is called TD-LTE. It was developed by China Mobile in the recent years.

TD-LTE explained:

TD-LTE allows carriers to make use of unpaired spectrum that many of them already own. Compared to the previous standards GSM, EDGE, etc., TD-LTE's commercial release time period is very short, due to its later addition into the standards.

There are some essential similarities and differences between TD-LTE and classic LTE. Basically LTE has the following characteristics:

- Much faster upload and download speeds than the 3G.

- It can reach download speeds of over 150 Mbit/s and upload speeds of over 80 Mbits/s.

- It has a larger cell size where a single LTE cell tower can cover upto 100km. Although its size will be greatly diminished in urban areas, it is still a lot better than 3G.

- It can easily be upgraded as it was developed with the intention of making the implementation of upgrades easier down the line.

- It has a great advantage of being compatible with existing standards.

Differences and similarities between LTE and TD-LTE:

- They run on different bands of wireless spectrum. But the part of spectrum that carries the TD-LTE signal is a lot cheaper and has much less traffic.

- LTE and TD-LTE are so similar that both the networks can be accessed by the same chip, which is easier for handset manufacturers.

- 4G, WiMAX standards are not compatible with LTE, but compatible with TD-LTE.

TD-LTE technical specifications:

- TD-LTE is specified to operate in the frequency range of 1850 to 2620 MHz.

- It uses the same MIMO (Multiple Input, Multiple Output) scenarios.

- There are two frame configurations, each with an overall length of 10 milliseconds and divided into 10 subframes as shown in the figure above.

- That is, the transmitted signal is organized into subframes of 1 millisecond.

- There is only one single carrier frequency and the transmissions (uplink and downlink) in the cell are always separated in time.

- The 5ms version has two special subframes when compared to one in the 10ms version which provides greater chances of uplink/downlink flexibility.

- The frame can be dynamically configured to any one of the above depending upon the transmission requirement.

- Each one millisecond downlink subframe contains blocks of data called “Resource Blocks” meant for a number of different users.

- Uplink subframe contains blocks of data from the users to the Base Station.

- The specified latency time is 5 ms or only half a frame for small data packets.

- The current system is made such that the stationary or pedestrian users or the low speed users experience operations done at the highest speed.

- There is no need to develop new devices for using TD-LTE. It's enough to add TD-LTE support to the existing devices.

- There is a lot of TDD spectrum available and it is cheap in cost.

- The increasing availability allows transition of WiMAX (Worldwide interoperability for Microwave Access) operators to TD-LTE using the same allocated spectrum.

- Industry commitment is great without any limitations.

TD-LTE will bring in new challenges to developers and vendors of design. New schemes, new configurations, higher system bandwidths, higher system capacity, lower latency are some of the expected challenges. There is a prediction that there will be 30 to 80 million subscribers and over £70 billion in operator revenues within 5 years.

Sunday, August 15, 2010

FTTH and LTE help increase focus on wholesale

- Results: incumbents (KPN, DT, BT, Telefonica, Belgacom, FT, Bell Aliant), mobile (Sprint), cablecos (Liberty Global, Telenet, Ziggo, Virgin Media, ONO, Comcast).

- Financing: Reggefiber got its desired EUR 130m loan from the EIB.

- IPO: Skype's $100m plan.

- M&A: possible buyers (Telefonica, PT, Vodafone, FT, TI) and sellers (PT, TI, Vodafone).

- FTTH: lots of deployments announced (inclusing China and India).

- NBNs and NBPs: Australia expands coverage plans to 93%, New Zealand receives 15 bids, the US awards another round of funds.

- LTE: several deployments announced.

- 4G: Clearwire moving closer to switching from WiMAX to LTE and the WiMAX2 standard gets ready for a 2012 launch.

- 1 Gbps: several MSO and telcos are now going beyond 100 Mbps, while ever more are eying 1 Gbps as the new frontier for bandwidth.

- Structural separation: proposal from Telecom NZ in order to be able to bid for the Crown Fibre plan.

- MVNO: KPN reports success with foreign MVNO operations (2G, 3G); Econet plans launch on the Everything Everywhere network (3G); Best Buy will do the same on the Clearwire network (WiMAX); Airspan is LightSquared's first wholesale customer (LTE); Tele2 NL started offering CATV on the networks of Ziggo and UPC (analogue TV); Chile considers a wholesale-only network (mobile and digital TV).

- BT was not allowed to raise wholesale prices to help stem the pension fund deficit.

- Apps: Google ended the development of Google Wave and acquired Slide; Samsung announced a developer contest.

- Net neutrality: Google and Verizon struck an agreement.

- Hybrid TV: Apple was rumoured to rework Apple TV into iTV, Cox partnered with TiVo and the Virgin UK/TiVo partnership added Cisco.

- The focus in the sector is shifting to Wholesale and OTT; FTTH and LTE are ongoing; wholesale is established as an important new business.

- M&A is focused on emerging markets, esp. Latam.

- Many incumbent telcos are still assembling global empires in order to be able to show growth. KPN is continuing on the wholesale path for growth.

- A telecoms network can be looked at as a vital piece of national infrastructure. If structurally separated, its cash flows can be seen as a vital element of the governments budget (incl. retirement funding).

- Cablecos are outperforming telcos. If you split the business three ways, it becomes clear why. 1. Connectivity (access): Docsis 3 outperforms xDSL and provides cable with a growth engine. Utility rates are close to 80% in the Netherlands, still much higher than FTTH's. 2. Communication: a nice add-on for growth and loyalty, hitting incumbent telcos in their hearts. 3. VAS (incl. content): here cable is the incumbent and benefits from a considerable head-start on multiple fronts (network, digital services, content deals). The foremost risks include FTTH and non-linear TV/hybrid TV/OTT.

- NGNs (FTTH, LTE) are exploring their advantages: 1. Maximum symmetrical bandwidth. 2. Lowest opex, highest score on the green scale. 3. Options for open access and wholesale.

- OTT is a complex and uncertain field, but hybrid TV seems to be a promising direction.

Tuesday, July 06, 2010

Smart grid proponents have some explaining to do

We are doing a new broadband conference October 13, after an FTTH conference (September 2009) and a mobile broadband conference (June 2010). The program isn't finalised yet, but one of the thing to look forward to is smart grid and smart metering. Hopefully somebody will teach us the value of these things, because I haven't been convinced yet. In fact, I am inclined to be an opponent, as I will explain here. Since I am probably not alone erring, I hope an expert speaker will address these points:

We are doing a new broadband conference October 13, after an FTTH conference (September 2009) and a mobile broadband conference (June 2010). The program isn't finalised yet, but one of the thing to look forward to is smart grid and smart metering. Hopefully somebody will teach us the value of these things, because I haven't been convinced yet. In fact, I am inclined to be an opponent, as I will explain here. Since I am probably not alone erring, I hope an expert speaker will address these points: